A sunroom is an expensive dream for many homeowners. With the right financing, you can make this dream come true.

Adding a conservatory to the existing house is becoming more and more popular. Due to the special insulation due to the use of glass, the first rays of sunshine can already be enjoyed in spring. However, such a project is associated with not inconsiderable costs, which usually require well-considered financing. Furthermore, the expansion itself is not an uncomplicated undertaking. After all, you have to obtain a building permit and choose the right materials with the respective functions. There is also the question of how to carry out the construction project: Would you like to build it yourself or would you rather hire a company?

Adding a conservatory to the existing house is becoming more and more popular. Due to the special insulation due to the use of glass, the first rays of sunshine can already be enjoyed in spring. However, such a project is associated with not inconsiderable costs, which usually require well-considered financing. Furthermore, the expansion itself is not an uncomplicated undertaking. After all, you have to obtain a building permit and choose the right materials with the respective functions. There is also the question of how to carry out the construction project: Would you like to build it yourself or would you rather hire a company?

What is a conservatory?

Previously intended as a plant house, the function of a conservatory has increasingly turned into a living garden. The German Conservatory Association defines the term as follows:

"A conservatory is a closed extension to a building, an independent building or a structure integrated into the building with at least one wall surface and a large part of the roof surface made of translucent building materials (EnEV term: "glass roof ")." (Source: http://bundesverband-wintergarten.de/pages/fuer-die-fachbetriebe/definition-wintergarten.php)

The supporting structure is made of wood, metal or plastic. Conservatories are only declared as such if they are so stable in their roof and glass construction that they are both rain and windproof. For example, rooms that are multi-glazed on the wall but have a solid roof are not considered conservatories.

Financing: options and who they are suitable for

Here, the cost of adding or expanding a conservatory is around 2,000 euros per square meter, so building a small conservatory of around 30 square meters can cost as much as 60,000 euros. It is therefore a sum of money that most homeowners cannot readily add tocredit can be given. In order to finance such a construction project, however, there are a wide variety of loan options.

Financing option 1 - home savings contract:

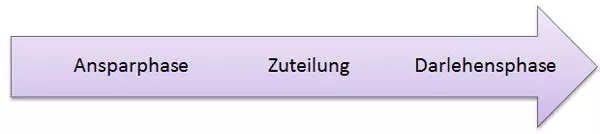

This is now one of the most common forms of real estate financing. As the name suggests, it is a savings contract with a building society, which is subsidized by the state. The prerequisite here is that the money saved is also used for a property, such as for the construction of a house or the expansion of the property with a conservatory. In principle, a home savings sum is agreed with the respective bank, which is saved in small monthly installments. In principle, three phases can be distinguished.

But what actually happens in the individual phases? The following table should bring clarity, because although the term "building loan contract" is clear to almost everyone, at least they know how the phases of this financing option work.

| Phase | What happens in this phase? |

|---|---|

| Saving phase | A certain amount of the agreed savings amount will be saved by a certain point in time. |

| Allocation phase | Basically, the savings amount is released to the home saver in this phase, provided that some assessment requirements are met, such as the agreed minimum savings amount or a minimum savings period. |

| Loan Phase | In this phase, the home saver has the entire amount saved. However, the interest on the bank loan has to be paid by the saver to the bank. |

According to the guide from ergodirekt.de, the advantages of a home savings contract are based on the following points:

- Fixed Interest

- Various forms of government funding possible

- Possibility of lending

- since savings contract, no equity required for lending

However, with such real estate financing, the usually lengthy savings phase must be considered. This time can be shortened, for example, by topping up an existing home savings contract. Furthermore, state funding is usually only worthwhile for high-income singles or families with three or more children.

Financing Option 2 - Bank Loan:

In most cases, an annuity loan is used, which is considered a classic form of loan and mostly with abank is completed. The respective loan is usually paid in monthly installments, which consists of an interest and a repayment part. Initially, the repayment portion is quite low and the interest portion is correspondingly large, which means that the repayment portion decreases slowly and then more quickly. The interest is a variable interest rate, whereby in most cases a fixed interest rate can be set for a certain period of time. Accordingly, such financing involves two risk factors:

Floating rate:

Depending on the market situation, the interest rate can develop both positively and negatively very quickly. However, the interest rate is currently so low that it can hardly be optimized as a fixed interest rate.

Late Amortization Time:

Such a loan does not take account of unforeseen changes. First, mainly the interest is paid off and only later does the repayment portion follow. Unemployment, for example, can result in high debts. Find out more from the experts at Finanzcheck.de

Financing option 3 - loan in combination with insurance:

With this type of loan, only the interest is initially paid off in monthly installments, so that the repayment debt remains. This is only paid after the term and usually in combination with life insurance or pension insurance. However, there is a high risk here due to variable interest rates and late repayment. In addition, life insurance is hardly worthwhile due to the usually low returns, as reported by the Handelsblatt.

Interim conclusion:

Which form of loan is ultimately suitable depends on various factors that must be taken into account when advising the respective bank:

- Is there a certain amount of equity?

- What is your current and future income situation?

- What is the family situation of the borrower?

- How many children does the borrower have?

- What savings, investments, insurance, etc. already exist?

Implementation of the construction project

The construction project should also be planned in parallel with the question of financing, which ultimately decides on the amount of the budget. When planning a conservatory, there are a number of factors to consider that affect conservatory construction and building permits.

The construction project should also be planned in parallel with the question of financing, which ultimately decides on the amount of the budget. When planning a conservatory, there are a number of factors to consider that affect conservatory construction and building permits.

Building Permit:

A building permit is required for the addition of aconservatory necessary because it is a structural change to the house. As soon as the winter garden represents a connection to the living space, this is also subject to approval. The conditions to be met when applying to the local building authority depend heavily on the region in question, which is why information on this should first be obtained before the project. In a few regions it can also be the case that the expansion of a house is ruled out from the outset. In most cases, the following information must be submitted to the building authority:

- Architect's Plan

- Floor plan or the location of the extension

- Information on statics

- Information on fire safety or energy saving measures

Conservatory construction:

Basically, a conservatory consists of two materials: glass and a support material such as wood, plastic or metal. Which carrier material should be used depends on the one hand on the respective budget and on the other hand on your own preferences. Here are some advantages and disadvantages of the most popular materials at a glance:

| Material | Advantages and disadvantages |

|---|---|

| wood | ✔ sustainable raw material ✔ easy to process ✖ high-maintenance |

| Plastic | ✔ easy to care for ✔ comparatively inexpensive ✖ comparatively unstable |

| Aluminium | ✔ easy to care for ✔ easy to work with ✖ comparatively expensive to buy |

The main building material remains the glass, although "normal glass" cannot be used here. Depending on the type and function of the glass, choose one with a U-value of 1.3 W/sqmK or more. With the growing energy-saving thoughts in society, the construction and functions of the glass have also evolved. There are different variants for every taste and budget. These include:

- Thermal insulation glass with additional functions such as sun protection or solar cells

- Self-cleaning glass treated with titanium dioxide during manufacture

Execution of the construction project with specialized companies:

An architect or civil engineer who takes into account the special properties of the construction of a conservatory should always be consulted during planning. But companies that are particularly familiar with conservatories should also be commissioned to carry out the construction project. Usually the respectiveArchitect involves various companies in the preparation of the offer, so that the client can decide on a suitable offer. With manual skills, it is certainly also possible to build the conservatory on your own, but you must have specialist knowledge.

Overall conclusion:

The desire for your own conservatory can be implemented in the best possible way thanks to structured planning. As mentioned, aspects such as the previous information about regional-specific requirements for an expansion of the house, obtaining a wide variety of information for financing and for the building permit to the bank and the local building authority are important. In any case, expert opinions should be obtained both for the financing and for the specific planning of the conservatory. If all important aspects are considered early on, the construction project can finally begin.